PredictRAM

Offering deep research & machine learning tools for better risk management

Registered Research Analyst Firm · Params Data Provider Pvt Ltd

SEBI RA Registration No. INH000022400

Three Innovative Products

Advanced Automated Trading Signal Platform for Hedge Funds - ODIN Terminal meets VS Code

✓ Configuration validated and saved

✓ Client accounts synchronized

✓ Risk parameters within compliance limits

QUAXAR Brain V4 Analyzing Market...

• Scanning 2,847 stocks across NSE & BSE

• Processing 156 client portfolios

• Running ensemble prediction models

• Applying risk management filters

✓ Signals Generated Successfully

• 3 BUY signals | 1 SELL signal

• Avg Confidence: 91.3%

• Total Capital Deployed: ₹42.7 Cr across 156 clients

• Risk Score: 0.68 (Within limits)

• Execution Time: 247ms

Browse and select from curated AI strategies with transparent performance metrics and risk profiles.

Manage hundreds of client accounts with automated capital allocation and individual risk controls.

Advanced ensemble AI combining LSTM, Transformer, and reinforcement learning for superior predictions.

Sub-second signal generation and automated order placement with comprehensive monitoring dashboards.

Pre-Event Research & Decision Guidance Engine - AI-Powered Portfolio Protection Platform

✓ PreEdge Basket Created Successfully!

• Protection Basket ID: PEB-20260203-NF50-PWR-156789

• Strategy: Power Protection (15% Downside Buffer)

• Index: NIFTY 50 @ 22,847.30

• Your Portfolio is Protected: 19,420 - 25,589 range

• Event Coverage: Q4 Earnings Season

• Status: ACTIVE | Real-time Monitoring Enabled

Navigate RBI meetings, Budget announcements, elections, and earnings with structured hedging strategies.

Choose from 9%, 15%, 30% buffers, or 100% Floor Baskets based on your risk appetite and market outlook.

Protection available for NIFTY 50, Bank NIFTY, Midcap, and IT indices with customized basket creation.

Intelligent event analysis and basket recommendations powered by machine learning algorithms.

Professional AI-Powered Trading & Analytics Platform with Advanced Machine Learning Models

ML Terminal Suite initialized successfully

Loading advanced prediction models...

Connecting to real-time market data feeds...

Status: Running ensemble prediction for RELIANCE

Models: LSTM + XGBoost + Random Forest

Timeframe: Next 30 days

Confidence Threshold: 85%

Target Price: ₹2,847.30 (+1.2%)

Confidence Level: 89%

Risk Score: Medium (0.65)

Recommended Action: BUY

Stop Loss: ₹2,720

Take Profit: ₹2,950

Portfolio Analysis: Complete

Total Value: ₹15,47,832

Risk Score: 0.72 (Medium-High)

Expected Return: 12.4% (annualized)

VaR (95%): -₹1,24,627

Hedging Recommendation: Available

Ensemble methods combining LSTM, XGBoost, and Random Forest for superior prediction accuracy and robust performance.

Live market data processing with instant risk assessment and portfolio optimization recommendations.

Comprehensive risk analysis with VaR calculations, stress testing, and automated hedging strategies.

Curated research-driven recommendation with clear risk / return profiles.

Designed for investors seeking alpha from under€‘covered names while maintaining disciplined downside controls.

Request DetailsSuitable for capital preservation mandates seeking stable cash flows with intelligent yield enhancement.

Explore BondsBuilt for sophisticated investors comfortable with episodic volatility in pursuit of asymmetric outcomes.

Request AccessAll our ML models are carefully evaluated on multiple dimensions, giving investors confidence in both performance and reliability. Whether you invest in equities, sectors, or quantitative strategies, our platform ensures transparency and ease of use.

Connect ML models with your portfolio and manage the most complicated risk management needs with ease. Just plug & play ML models supported by clear evaluation scores across: Risk & Return, Data Quality, Model Logic, Code Quality, Testing & Validation, and Governance & Compliance.

Focus on individual stocks & indices. Surfaces trading opportunities, fair value gaps, and portfolio risk insights for both active traders and long-horizon investors.

Analyzes Banking, Pharma, IT, Manufacturing & more. Detects cyclical turns, macro linkages, and relative strength to guide allocation shifts.

Advanced quantitative factor, statistical arbitrage & optimization frameworks engineered for consistent, risk€‘adjusted alpha.

Co-Founder & Vice Chairman

PB Fintech (policybazaar)

Ex Director

Moody's Analytics

Ex GM

Dena Bank

Associate Director

Indian School of Business

Co Founder AngelBay

Ex Crisil AVP

CEO

FAAD Network Private Limited

Our Team

Founder & CEO

Financial Market Professional, IIT Kanpur Fellowship holder, and Innovator of Portfolio Risk mitigation technology using AI and Tokenization under TIDE 2.0 EIR Meity Govt of India

14+ years in equity, derivatives, currency, portfolio management, and financial instruments. Over 6+ years of coding experience with proficiency in PHP, jQuery, MySQL Database, R programming language, ARIMA, ARMA, ANN, CNN, RNN, LSTM, GARCH, VaR, Monte Carlo methods, Options Greeks, and Currency strategy payoff models. CFA US Candidate. Certified arbitrageur and algo trading operations from BIFM

Co Founder & Core Team

Ex Assistant Professor of University of Delhi, Ph.D. in Finance, Research Scholar at Department of Commerce Delhi School of Economics. Author of several research papers on finance and econometrics. CFA US Candidate.

8+ years of academic experience, University Gold Medalist in Bachelor of Business Studies. Lifetime member of the Indian Accounting Association.

Tech Lead

Creative Full-Stack Developer with 3+ years of expertise in Software Architecture, Testing, Blockchain, and cloud-based backend infrastructure. Proficient in RESTful APIs and Front-End Development.

First-hand expertise in Software Architecture, Testing, Blockchain, and cloud-based backend infrastructure. Mastery in RESTful APIs and Front-End Development.

Freelancer & Full Stack Developer

IIT Madras BSc

Vast exprerience in AI,ML

Tech & Backend Developer

Handling backend development work

Sr.Backend developer

He is a great man to work Lorem ipsum dolor sit amet, consec tetur adipis icing elit. Simi lique, autem.

Tenetur quos facere magnam volupt ates quas esse Sedrep ell endus mole stiae tates quas esse Sed repell endus molesti aela uda ntium quis quam iusto minima thanks.

With help from our teams, contributors and investors these are our achievements

Incubated by SIIC IIT Kanpur incubation program

During BITS Pilani Conquest 2022. In top 11 starts out of 2000+ startups

Presented PredictRAM at Google Asia Pacific HQ in Singapore during the Fintech accelerator program.

Finalist of Empresario 2022 is the annual business model competition organized by Entrepreneurship Cell, IIT Kharagpur

On top 11 out of 2000+ Startups by BITS Pilani Conquest 2022

Winner - Best FinTech DeFi Product by KardiaChain Pioneer contest ۠Southeast Asia۪s Premiere #Blockchain Ecosystem

Selected for IIIT Lucknow accelerator program

Showcase NASSCOM Featured report.

At our company, we believe that the key to success in today's digital world is to leverage the power of computer intelligence for speed and scalability, while also relying on human intelligence for trust and reliability.

We've developed a unique approach that blends these two types of intelligence seamlessly, resulting in a powerful and efficient solution that's unmatched in the industry.

Our cutting-edge technology is designed to work alongside SEBI registered advisors and research analyst, providing powerful insights and data-driven solutions that are faster and more accurate and affordable than ever before.

Deep data Analysis of Global Economy, Industry & Company Parameters

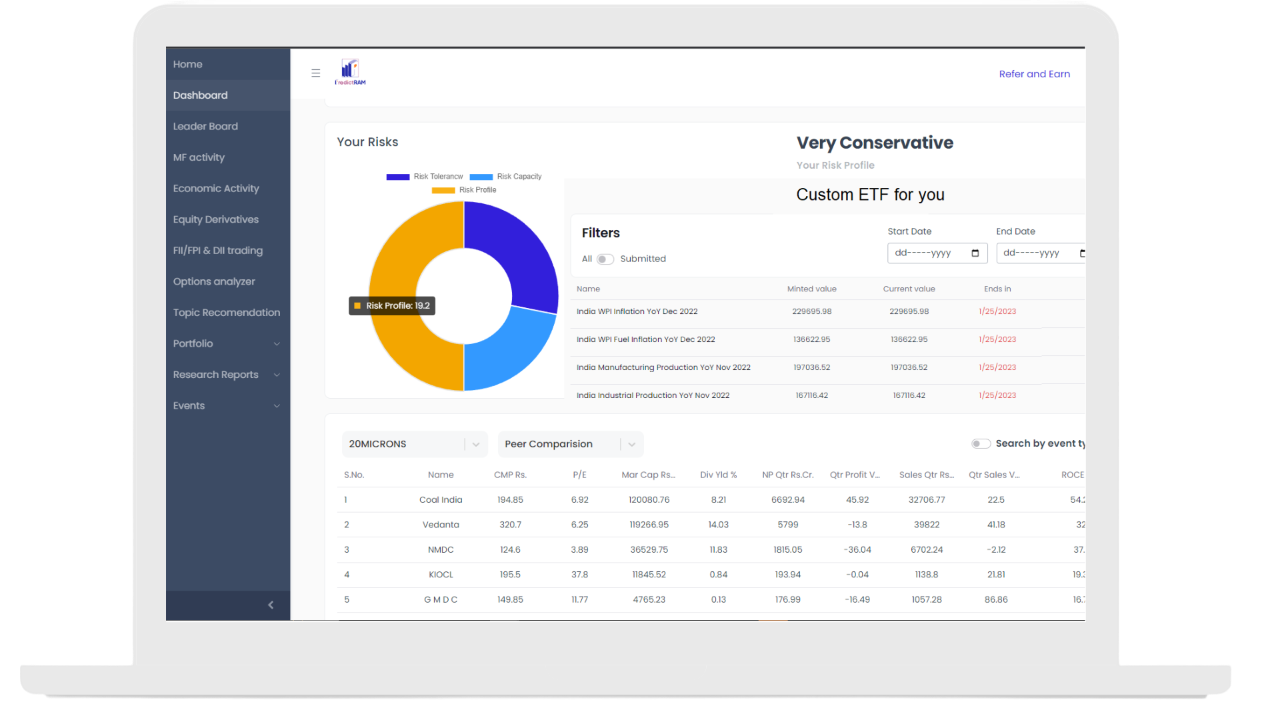

Measures and quantifies the level of financial risk within an individual portfolio

Experience advanced technology. With three easy steps redice your portfolio risk at an affordable cost with us.

Deep insights of global markets financial and econpomic events and risk adjustment capabilites under same roof.

Integration feature with all trading and Demat accounts with PredictRAM dashboard can help investors manage their investments effectively, execute trades efficiently.

The game-changer for investors is the accessibility of high-end AI investing instruments at a very affordable cost.

Risk mitigation strategies through customized ETF execution capabilities before the event that help investors make informed decisions about their investments

By following these three easy steps, you can find, manage & mitigate the risk of your portfolio and achieve your long-term financial goals.

SLIPS 9.5% coupon rate bonds across various industries, with flexible adjustment frequencies and tailored allocations. Their strategy involves thorough industry analysis to recommend sector-specific or unrelated bonds based on outlook, optimizing growths based on investor needs.

Learn more Connect NowFLIPS offers bonds linked to the CPI, adjusting for inflation to preserve purchasing power and ensure real growths. These bonds provide inflation protection, higher interest rates than traditional bonds, and risk mitigation, with features like quoted yield RFQ facilities and high liquidity

learn more Connect NowA technology stack can help in the quick and accurate assessment of portfolio risk. The use of data analytics, artificial intelligence (AI), and machine learning (ML) can help in identifying potential risks and analyzing historical data to assess the probability of risks occurring.

A technology stack can help portfolio managers make informed decisions by providing access to real-time data and analytics. This can help in identifying emerging risks and assessing the potential impact on portfolio performance.

A technology stack can streamline portfolio risk management processes, reducing the need for manual interventions. This can help in reducing costs and improving efficiency, while also minimizing the risk of human error.

A technology stack can help in ensuring regulatory compliance by providing accurate and timely reporting. This can help organizations avoid regulatory penalties and fines.

An AI-powered dashboard can provide many benefits for a registered advisor, including:

White-label ML models: We offer white-label ML models advisors can deploy for better risk management of their clients' portfolios€â€easy integration, real-time data feeds, and fast results.

Real-time insights: AI-powered dashboards can provide real-time insights into market trends and client portfolios, allowing advisors to make informed decisions quickly.

Time-saving: AI-powered dashboards can save advisors time by automating repetitive tasks, such as data entry and report creation.

Improved client communication: With an AI-powered dashboard, advisors can communicate with their clients more effectively by sharing data-driven insights and recommendations.

Competitive edge: With access to AI-powered insights and recommendations, advisors can gain a competitive edge by offering more advanced and personalized services to their clients.

An AI-powered risk management dashboard can provide many benefits for investors, including:

Real-time risk assessment:An AI-powered dashboard can analyze market data in real-time and provide investors with up-to-date information on the risks associated with their investments.

Customized risk analysis:AI-powered risk management dashboards can analyze each investor's risk tolerance and investment goals, and provide customized risk analysis based on that information

Automated alerts:AI-powered risk management dashboards can provide automated alerts when certain risk thresholds are breached, enabling investors to take timely action to mitigate risk.

Cost savings:AI-powered customized ETF's can help investors optimize their portfolios and potentially reduce investment costs.

Professional-grade strategy marketplace with live trading signals powered by QUAXAR Brain and Qunius-RL AI engines

Sign in to access AI-powered trading signals

🔐 Login to PredictRAMAdvanced deep learning engine combining LSTM, Transformer, and reinforcement learning for superior market predictions.

Access curated strategies from top-performing algorithms with transparent performance metrics and risk profiles.

Built-in position sizing, stop-loss management, and portfolio-level risk controls for capital preservation.

Automated KYC verification and comprehensive CRM solutions designed for investment advisors and research analysts with full regulatory compliance

Comprehensive eKYC automation and CRM platform designed specifically for investment advisors and research analysts with full regulatory compliance.

Real-time KRA & CKYCRR uploads with seamless integration. Fully regulation-ready with comprehensive audit trails.

Complete client management system with portfolio tracking, invoice generation, and automated communication workflows.

Audit-ready from day one with complete regulatory compliance, documentation, and professional consultation support.

Regulatory Info: Built for SEBI-registered Research Analysts (Reg: INH000022400) and Investment Advisors requiring professional compliance solutions.

Before investing, it is important to analyze your individual risk appetite to determine what types of investments are appropriate for your financial situation and goals. Risk appetite refers to your willingness to take on risk in pursuit of potential growths. It is influenced by various factors such as financial resources, investment goals, and tolerance for uncertainty.

Economic indicators: Economic indicators such as GDP, inflation, employment data, and interest rates can have a significant impact on the markets.

Corporate earnings: The earnings reports of individual companies can impact their stock prices, as well as the broader market.

Government policies: Changes in government policies, such as tax rates, regulations, or trade agreements, can have a significant impact on specific industries or the broader market.

Geopolitical events: Political events such as elections, wars, and natural disasters can create uncertainty and volatility in the markets.

Central bank decisions: Decisions by central banks, such as changes in interest rates or monetary policy, can impact the markets.

Company news and events: News such as mergers and acquisitions, product launches, or management changes can impact the stock prices of individual companies.

Event-specific customized ETFs can provide investors with a convenient way to participate in specific events without having to research and select individual securities.

We are using AI,ML technologies to curate all the event specific ETFs suggested by the SEBI registered advisors and research analyst.

Here Are the 11 Fintechs Joining F10€™s Latest Accelerator Programme in Singapore

Meet The 16 Indian Startups That Caught Our Eye At BITS Pilani€™s €˜Conquest€™ Accelerator

Get notified about the details, as well as other important development update.

Our GenAI & ML powered platforms delivering automation, intelligence & risk transparency.

Streamlines client management with eKYC, eSign & IVR call recording ensuring secure, compliant automation.

Book DemoPatented tokenized portfolio risk management + real€‘time surveillance using LLMs, RAG & market monitoring.

Book DemoDeep learning & quantum€‘ready modeling for predictive analytics and advanced risk intelligence.

View Platform